LinkedIn Outshines X and Snapchat in Mobile Revenue Race

Since Elon Musk’s acquisition of Twitter in late 2022, the search for alternatives has seen numerous contenders emerge, from niche startups to substantial ventures like Instagram’s Threads. Amidst this crowded space, LinkedIn is emerging as a formidable but often overlooked competitor. According to traffic analytics from Similarweb, LinkedIn’s web traffic in March showed an impressive increase of 10.6% year-over-year, contrasting sharply with a 15.2% decline for X (formerly Twitter).

LinkedIn is the Twitter/X rival no one is talking about – TechCrunchhttps://t.co/MhyMgtKhdH

— Fook.News (@FookNews) May 1, 2024

When comparing the figures from November 2022—immediately after Musk’s takeover—to those in March, the data is even more telling. X experienced a 10% drop in web traffic, while LinkedIn saw an 18% increase. Despite LinkedIn’s total user base being smaller, with 269.2 million unique visitors in March compared to 727.6 million for Twitter/X, the growth rate of LinkedIn is notable, marking an 11.1% rise year-over-year.

Moreover, LinkedIn’s reach extends beyond web traffic. The platform has also seen a significant uptick in mobile engagement, with worldwide Android app usage increasing by 14% since November 2022, whereas X has witnessed a 20% decrease in the same period. This trend highlights LinkedIn’s growing relevance not just as a professional networking site, but as a viable platform for broader social media engagement in the current competitive landscape.

However, data from Appfigures presents a different perspective on mobile trends. While LinkedIn’s monthly downloads have increased by 10% year-over-year, X’s downloads have decreased by 24%. Appfigures suggests that this decline is more attributable to the rebranding of Twitter to X rather than shifts in consumer behavior. Furthermore, LinkedIn’s download rates have remained stable both before and after Elon Musk’s takeover of Twitter, indicating consistent performance across timeframes.

Despite these insights, the usage patterns on desktops and laptops, where many professionals spend their workdays, suggest a possible shift. Some business users might be migrating part of their web activity from X to LinkedIn, influenced by the changes and uncertainties surrounding Twitter’s transition.

Adding to this dynamic, LinkedIn is not just resting on its laurels as a professional network. Today, it introduced gaming features and is also planning to roll out short-form videos. These additions signal Microsoft’s intent to transform LinkedIn into a more engaging platform, capturing the interest of former Twitter users and tapping into the younger, digitally-savvy Gen Z demographic. This strategic expansion aims to position LinkedIn not only as a network for professional growth but also as a hub for more diverse social interactions.

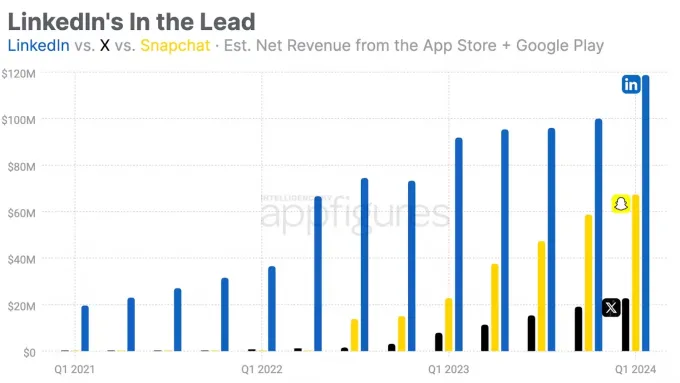

LinkedIn’s Mobile Revenue Surpasses X and Snapchat Combined

LinkedIn’s strategic approach to its mobile app seems to be paying off significantly. According to Appfigures, LinkedIn’s mobile app revenue now exceeds the combined totals of X (formerly Twitter) and Snapchat across both iOS and Android platforms. This is particularly noteworthy given that LinkedIn’s subscription fees are notably higher, starting at $29.99 per month and reaching up to $69.99, compared to X’s subscription range of $4 to $22 and Snapchat Plus at just $3.99 per month.

This pricing strategy means LinkedIn doesn’t need to secure as many subscribers to generate substantial revenue. Historically, LinkedIn has not struggled to outperform X and Snapchat in the mobile space. The growth trajectory of LinkedIn’s app revenue further underscores its success: soaring from $20 million in Q1 2021 to a record $91 million in Q1 2023, and achieving its highest-ever quarterly revenue at $119 million by Q1 2024.

In contrast, the combined revenues for X and Snapchat in the same quarter amounted to $90 million—$23 million from X and $67 million from Snapchat—illustrating just how much LinkedIn leads in monetizing its mobile user base.